Should I Register My Turbo Tax Software

| |

| Developer(south) | Intuit, Inc. |

|---|---|

| Initial release | 1984 (1984) |

| Operating system | Windows, Macintosh, Android, iOS |

| Type | Revenue enhancement software |

| License | Proprietary |

| Website | turbotax |

Intuit Consumer Taxation Group headquarters in San Diego (where TurboTax is developed)

TurboTax is a software package for preparation of American income tax returns, produced past Intuit. TurboTax is a market leader in its product segment, competing with H&R Cake Taxation Software and TaxAct.[1] TurboTax was developed past Michael A. Chipman of Chipsoft in 1984 and was sold to Intuit in 1993.[2] [three]

The company has been subject of controversy over its political influence and deceptive business practices. Intuit, the maker of TurboTax, has lobbied extensively confronting the Internal Revenue Service (IRS) creating its own online system of revenue enhancement filing like those that exist in about other wealthy countries.[4] [5] [6] Intuit is nether investigation by multiple state attorneys general, also as New York's Section of Fiscal Services.[7] [8]

Equally office of an understanding with the IRS Gratuitous File plan, TurboTax allowed individuals making less than $39,000 a yr to utilize a gratis version of TurboTax; a 2019 ProPublica investigation revealed that TurboTax deliberately fabricated this version hard to notice, fifty-fifty through search engines, and that information technology deceptively steered individuals who search for the free version to TurboTax versions that cost coin to use.[9] TurboTax has tricked military service members to pay to use the filing software by creating and promoting a "military disbelieve" and by making the free version hard to find when many service members are in fact eligible to employ the software for complimentary.[10]

Overview [edit]

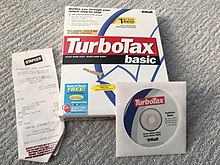

Packaging for TurboTax Basic 2003

Intuit Consumer Revenue enhancement Grouping is based in San Diego, California.[11] Intuit Corporation, which owns Intuit, is headquartered in Mountain View, California.[12]

There are a number of different versions, including TurboTax Deluxe, TurboTax Premier, etc. TurboTax is available for both federal and state income tax returns. The software is designed to guide users through their revenue enhancement returns step-by-step. The TurboTax software provides taxpayers additional support for their cocky-prepared returns by offering Audit Defence from TaxResources, Inc.[xiii]

Typically, TurboTax federal software is released belatedly in the year and the country software is released mid-Jan to mid-Feb.[14] TurboTax normally releases its new versions equally soon every bit the IRS completes revisions to the forms and approves the TurboTax versions, usually late in the tax twelvemonth. The process is like for states that collect income taxes.

In 2001, TurboTax saved financial institution passwords entered past users to servers at Intuit and the home computer.[15] The programming error was reportedly fixed, but as of 2012 TurboTax offers no option to download a data file directly from the financial establishment. Instead, it prompts the user for their login name and countersign at the financial establishment or permits the data to be entered by hand.[16]

In 2003, Intuit faced vocal criticism for its TurboTax activation scheme.[17] The visitor responded past removing the product activation scheme from its product. In 2005 TurboTax extended its offer by assuasive whatever taxpayer to use a bones version of its federal product for free every bit office of the Free File Alliance. By 2006 that offer has been limited to free federal online tax training and e-file for taxpayers whose adapted gross income is $28,500 or less (or $52,000 for those in the military) and those 50 or under. TurboTax has received a number of complaints regarding its advertising of the free version. For filers who use this basic version of the software, federal filing is gratis. Even so, state revenue enhancement filing is non free, and the price of using TurboTax to file state returns is not presented to the user until they've already completed inbound their information for federal returns.

In 2008, Intuit raised the price of TurboTax for desktop customers by $15 and included a free e-filing for the first render prepared.[18] The visitor'due south new "Pay Per Return" policy was criticized for adding a $nine.95 fee to print or e-file each boosted return later on the first, including returns prepared for members of the aforementioned household. On December 12, 2008 the company announced that it had rescinded the new policy.[xix]

On January 21, 2009, TurboTax received considerable public attending at the Senate confirmation hearing of Timothy F. Geithner to be the United States Secretary of Treasury. Geithner had testified that he used TurboTax to prepare his tax returns for the years 2001 to 2004 merely had incorrectly handled the self-employment taxes due as a result of his beingness employed by the International Budgetary Fund. Geithner fabricated it clear that he took responsibleness for the error, which was discovered in a subsequent IRS audit, and did not blame TurboTax. Geithner paid $42,702 in dorsum taxes. Intuit responded by releasing a statement saying "TurboTax, and all software and in-person taxation preparation services, base of operations their calculations on the data users provide when completing their returns."[20]

On July 15, 2021, Intuit announced its withdrawal from the Costless File Brotherhood, effective subsequently the taxation flavor final in October 2021, stating that "due to the limitations of the Free File plan and conflicting demands from those outside the program, we are not able to continue in the program."[21]

International versions [edit]

Intuit also addresses Canadian tax returns with an entirely separate product too named TurboTax, but previously called QuickTax. The French version has retained its original proper noun ImpôtRapide until 2017, when it was renamed TurboImpôt.

Controversies [edit]

Blocking search engines from indexing its "free file program" folio [edit]

Citizens of the Us that make up to $72,000 per year are eligible for gratuitous training and filing of revenue enhancement forms through the IRS Gratis File program.[22] However, TurboTax's "free file program" page (https://turbotax.intuit.com/taxfreedom/) contains specific HTML tags (noindex, nofollow) which block search engines from indexing it.[23] TurboTax has been deceiving customers which were eligible for the complimentary submission into signing upwardly for their commercial product.[24] Starting December 30, 2019, nether a new understanding from the IRS, TurboTax can no longer hibernate their free version services from search results.[25]

Writing to the boot track [edit]

The 2003 version of the TurboTax software contained digital rights management that tracked whether information technology had previously been installed on a computer past writing to sector 33 on the hard drive. This allowed it to rails if information technology was on a reckoner previously, even through reinstalling the operating system. This likewise acquired it to conflict with some boot loaders that store data at that place, rendering those computers unbootable.[26]

Opposition to return-costless filing [edit]

Intuit, the owner of TurboTax, spent more than $eleven meg on federal lobbying between 2008 and 2012. Intuit "opposes IRS government tax preparation", particularly allowing taxpayers to file pre-filled returns for gratis, in a system like to the established ReadyReturn service in California. The company too lobbied on bills in 2007 and 2011 that would have barred the Treasury Department, which includes the IRS, from initiating return-free filing. An Intuit spokeswoman said in early 2013 that "Like many other companies, Intuit actively participates in the political process." She said that return-free filing had "implications for accuracy and fairness in taxation."[27] [28] This led journalist Dylan Matthews to propose a boycott of the visitor in 2017.[29] [30]

In its 2012 Class 10-K, Intuit said that "Nosotros conceptualize that governmental encroachment at both the federal and state levels may nowadays a continued competitive threat to our business for the foreseeable future."[27]

Repositioning of versions [edit]

In January 2015 it became known that the Deluxe version no longer supports IRS Schedules C, D, E, and F in interview fashion. Although the Palatial version still allows entry into those schedules by means of "course mode", doing then may effect in the loss of the power to file electronically. In addition, the Premium version no longer supports Schedule C or F in interview way. Intuit was widely criticized for these changes and responded with short-term mitigation, although it has non reversed the conclusion.[31] On Feb 5, 2015 Intuit sent a second e-mail apology to current and former customers regarding the decision to remove specific schedules from the Deluxe and Premium versions. Intuit as well apologized for their poorly received initial amends sent on January 27. In the February 5 message Intuit announced that they would reverse course in their 2015 Deluxe and Premium versions, including the schedules that were historically included in the software.[32]

Fraudulent return claims [edit]

In an article by Brian Krebs on February fifteen, 2015 it was reported that Intuit Inc. temporarily suspended the transmission of land due east-filed taxation returns due to a surge in complaints from consumers virtually refunds already claimed in their name.[33]

In a later article on February 22, 2015, Krebs reported that it was alleged by two sometime employees that Intuit knowingly allowed fraudulent returns to be candy on a massive calibration equally part of a acquirement boosting scheme. Both employees, former security squad members for the company, stated that the company had ignored repeated warnings and suggestions on how to prevent fraud. One of the employees was reported to have filed a whistleblower complaint with the The states Securities and Exchange Commission.[34]

Diverting stimulus funds away from customers [edit]

In 2021, some individuals who used Turbotax for their taxation filings were unable to admission stimulus checks sent past the authorities because Turbotax diverted the checks to old and unused banking company accounts for the customers.[35]

Deceptive advert of its "gratis" revenue enhancement filing products [edit]

In March 29, 2022, the Federal Trade Commission appear that they would take legal action confronting Intuit, the parent company of TurboTax in response to deceptive advertising of its free tax filing products. The commission reported that the majority of taxation filers cannot use any of TurboTax's free products which were advertised, claiming that information technology has misled customers to believing that tax filers tin can utilise TurboTax to file their taxes. In addition, tax filers who earn farm income or are gig workers cannot be eligible for those products.[36] [37] Intuit announced that they would take counter action, announcing that the FTC'southward arguments are "not credible" and claimed that their free revenue enhancement filing service is bachelor to all taxation filers.[38]

References [edit]

- ^ Grayness, Tim (February eleven, 2012). "Taking Taxation Software for a Walk". The New York Times.

- ^ "Michael Chipman". People. Forbes. April eighteen, 2012. Archived from the original on May xvi, 2009. Retrieved Dec 12, 2013.

- ^ Groves, Martha (September 2, 1993). "Intuit, Chipsoft Concord to Merge in $225-Million Deal". Los Angeles Times . Retrieved December 29, 2016.

- ^ Elliott, Justin (April 9, 2019). "Congress Is Nigh to Ban the Government From Offering Free Online Tax Filing. Thank TurboTax". ProPublica . Retrieved April ix, 2019.

- ^ Mean solar day, Liz (March 26, 2013). "How the Maker of TurboTax Fought Costless, Unproblematic Tax Filing". ProPublica . Retrieved April 9, 2019.

- ^ Justin Elliott, Paul Kiel (Oct 17, 2019). "Inside TurboTax'southward 20-Twelvemonth Fight to Stop Americans From Filing Their Taxes for Costless". ProPublica . Retrieved Oct 17, 2019.

- ^ Elliott, Justin (May 10, 2019). "New York Regulator Launches Investigation Into TurboTax Maker Intuit and H&R Cake". ProPublica . Retrieved May 23, 2019.

- ^ Elliott, Justin (December 19, 2019). "TurboTax Tricked Customers Into Paying to File Taxes. Now Several States Are Investigating It". ProPublica . Retrieved December 30, 2019.

- ^ Justin Elliott, Lucas Waldron (April 22, 2019). "Here's How TurboTax Just Tricked You Into Paying to File Your Taxes". ProPublica . Retrieved April 22, 2019.

- ^ Justin Elliott, Kengo Tsutsumi (May 23, 2019). "TurboTax Uses A "War machine Disbelieve" to Fob Troops Into Paying to File Their Taxes". ProPublica . Retrieved May 23, 2019.

- ^ Horn, Jonathan (November 9, 2014). "Intuit: An atmosphere to excel". The San Diego Union-Tribune . Retrieved December 29, 2016.

- ^ "Corporate Profile". Intuit. Retrieved Dec 12, 2013.

- ^ "TurboTax Support: Audit Defense". Intuit. December 6, 2013. Archived from the original on July nine, 2013. Retrieved Dec 12, 2013.

- ^ "Intuit TurboTax Lodge Condition FAQs (2009)". Intuit. Retrieved Dec 12, 2013.

- ^ "TurboTax Security Glitch May Force 150,000 Investors to Alter Passwords". Los Angeles Times. April 6, 2001. Retrieved March 4, 2012.

- ^ "Importing Your W-2, 1099, and 1098 Forms". Intuit. September 9, 2013. Archived from the original on May xxx, 2013. Retrieved December 12, 2013.

- ^ Metz, Cade (Oct ane, 2003). "Intuit'south TurboTax Activation Scheme Irks Users". PC Magazine . Retrieved June 13, 2007.

- ^ "Why has the price of TurboTax increased past $15 this year?". Intuit. Retrieved December 12, 2013.

- ^ Elmblad, Shelly (November 25, 2008). "TurboTax Removes E-file Fees". Well-nigh.com . Retrieved December 3, 2008.

- ^ Ahrens, Frank (January 22, 2009). "Treasury Pick Misfiled Using Off-the-Shelf Tax Software". The Washington Post. p. D1.

- ^ "Accelerating Engineering science Innovation to Better Help Consumers Solve Their Virtually Pressing Financial Issues". Intuit Weblog. July 15, 2021. Retrieved December 16, 2021.

- ^ "Costless File: Do your Federal Taxes for Free | Internal Revenue Service".

- ^ "Ok, so I merely read this article near Turbotax doing shady things and found out something really interesting".

- ^ "Here's How TurboTax Simply Tricked You into Paying to File Your Taxes".

- ^ "TurboTax, H&R Block Tin't Hide Complimentary Filing Services Under New IRS Understanding". Business organization Insider.

- ^ Becker, David (January 6, 2003). "Intuit pours oil on TurboTax troubles". CNET.

- ^ a b Solar day, Liz (March 26, 2013). "How the Maker of TurboTax Fought Complimentary, Simple Taxation Filing". ProPublica.

- ^ Burman, Len (April 15, 2013). "The Taxation Complexity Lobby". Forbes.

- ^ Matthews, Dylan (March 29, 2016). "Why I'thou boycotting TurboTax this twelvemonth". Vocalism . Retrieved April 1, 2017.

- ^ "The Call for Boycotting TurboTax". Institute for Policy Studies. Retrieved Apr ane, 2017.

- ^ Novack, Janet (January 22, 2015). "Intuit Offers $25 Refund To TurboTax Deluxe Users Hurt By Software Changes". Forbes.

- ^ "Intuit Cries Uncle, Will Reverse TurboTax Deluxe Changes". Forbes . Retrieved November 24, 2015.

- ^ "Citing Tax Fraud Spike, TurboTax Suspends Land Eastward-Filings". Krebs on Security. February half dozen, 2015. Retrieved Nov 24, 2015.

- ^ "TurboTax's Anti-Fraud Efforts Under Scrutiny". Krebs on Security. February 22, 2015. Retrieved November 24, 2015.

- ^ Adamczyk, Alicia (March 17, 2021). "TurboTax and H&R Cake said they worked with the IRS to prepare stimulus check deposit issues. Customers say they still tin can't access the funds". CNBC . Retrieved March 18, 2021.

- ^ "FTC Sues Intuit for Its Deceptive TurboTax "gratis" Filing Campaign" (Press release). Federal Trade Commission. March 29, 2022.

- ^ Arbel, Tali (March 29, 2022). "FTC sues Intuit to stop 'allurement-and-switch' TurboTax ads". Associated Press . Retrieved March 29, 2022.

- ^ Dress, Bradd (March 29, 2022). "FTC sues Intuit over TurboTax 'costless' filing ad entrada". The Hill. Nexstar Media.

External links [edit]

- Official website (paid tax filing)

- IRS Gratuitous File Program on Intuit official website (free tax filing)

Should I Register My Turbo Tax Software,

Source: https://en.wikipedia.org/wiki/TurboTax

Posted by: whitehatian.blogspot.com

0 Response to "Should I Register My Turbo Tax Software"

Post a Comment