Does A Registered Boat Have To Fly Us Flag

This story is being co-published with Capital letter&Main

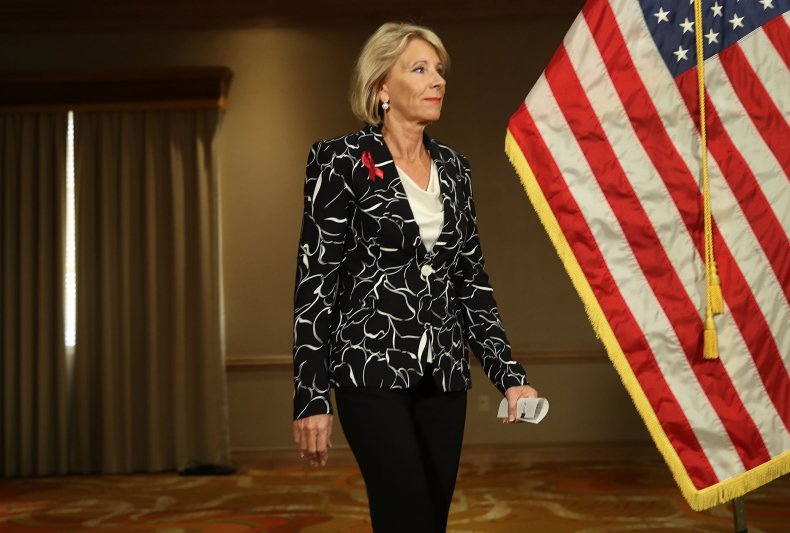

When someone untied a yacht owned by U.S. Secretary of Education Betsy DeVos's family unit, the episode was portrayed as an instance of anti-Trump harassment. Merely the yacht's strange flag illustrated how an allegedly "America Offset" assistants is total of moguls who accept stashed their wealth offshore in ways that aid them avoid taxes, regulations, transparency requirements and domestic employment laws.

We already know that Transportation Secretarial assistant Elaine Chao's family shipping consortium routes its business through the Marshall Islands—a notoriously secretive tax haven. Federal records detail how Trump'due south Commerce Secretarial assistant Wilbur Ross, Securities and Commutation Committee Chairman Jay Clayton and Federal Reserve lath appointee Randal Quarles held parts of their personal fortunes in investments based in the Cayman Islands, which are non necessarily required to adhere to America's domestic financial regulations.

Now there's DeVos, one of the heirs of Amway'due south multilevel marketing empire. When the family'south 164-pes yacht was untethered from a Huron, Ohio, dock, it was flying a flag of the Cayman Islands, where the yacht is registered, according to VesselTracker. Co-ordinate to federal records, the yacht is owned by RDV International Marine, which is an affiliate of the visitor that controls the DeVos family's fortune.

Like those of other Trump officials, DeVos'southward investment portfolio includes Cayman holdings. But as a concrete vessel, the yacht is something split up and more tangible, raising a question: Why would an American billionaire's floating palace moored at a northern Ohio dock exist registered in an exotic Caribbean area archipelago?

Betsy DeVos did not respond to Capital & Main'south questions about her family'southward Cayman-registered yacht; the larger question about foreign yachts was never deeply explored during the 2012 kerfuffle over the foreign flags on Mitt Romney's boat. Interviews with maritime attorneys suggest it is a scheme that allows wealthy Americans to feign foreign status—and glean the lucrative benefits offered by offshore tax havens.

When buying a vessel or cruising in U.S. waters, American yacht owners similar the DeVos family unit could face state sales or use taxes like those most nonyacht owners face on everything else. Yet, registering a yacht in a locale like the Caymans—under what has come to be known as a "flag of convenience"—allows those American yacht owners to finer characterize themselves as foreigners for taxation purposes, thereby fugitive the obligation of paying the standard levies.

"If you want to come in and use the waters of a given state of the United States, the question is how can you insulate yourself from getting hit for the employ tax?" maritime attorney Michael T. Moore told Capital & Principal. "The answer is: close and register offshore. If yous close and register offshore, you aren't subject to either a sales or a use tax. Yous are simply visiting the Usa, and you are visiting under a privilege that is granted to certain countries in the earth under what is called a cruising permit. Those countries grant the privilege to U.Southward. flagged vessels, and the United States offers that reciprocal right to vessels flagged by those countries. In practice, information technology means the permit allows yous to go from port to port in dissimilar states without having to officially make entry and pay taxes to the states of the ports yous visit."

DeVos's yacht is reportedly i of 10 in the family's fleet and is worth $twoscore million. If the vessel was registered in, say, Grand Rapids, Michigan—the state where RDV is located and that has in the past made an attempt to compel yacht owners to pay utilize taxes—the Seaquest would likely be bailiwick to Michigan's half dozen percent use revenue enhancement. That would require the DeVos empire to cough up about $2.4 million: public revenues that help finance the kind of police services that the DeVos yacht crew called when the boat was untied. With the Cayman flag fluttering on its deck, the family unit can avoid the levy even every bit information technology cruises the Great Lakes.

Some other incentive for yacht owners to register offshore is the potential to avert stricter inspection and safety standards required for U.S.-registered vessels of a certain size.

"If someone is ownership a boat that is above 300 gross tons only below 500 gross tons, getting registered offshore means they can avoid being discipline to U.S. Coast Guard inspection and certification requirements every bit either a 'seagoing motor vessel' or a 'passenger vessel,'" said maritime attorney Marker J. Buhler. "The near commonly used offshore yacht registries have comprehensive large yacht safety codes that were specifically developed for big yachts, whereas the U.S. Coast Baby-sit regulations and inspection requirements applicable to 'seagoing motor vessels' or 'rider vessels' were created many years ago principally for vessels engaged in merchandise, and non actually having large yachts in heed. Those requirements practice not translate well to yachts, and most yachts are merely not designed or congenital to those detail standards."

The DeVos yacht is 492 gross tons, co-ordinate to MarineTraffic.

In a 2009 presentation to the American Bar Association, Buhler said that yacht owners who register their vessels offshore may likewise be seeking "a level of anonymity not available in the U.S."—a reference to how offshore jurisdictions similar the Caymans require less transparency in their corporate disclosures. Buhler noted that "some taxation complimentary countries do non require any fiscal reporting" and added that such owners may besides be aiming "to avoid liability for sure U.S. legal obligations to crew members."

Offshore registration can likewise reduce labor costs.

"The reason otherwise ruddy-blooded American yachts fly not-American flags has little to practise with political sentiment, and a whole lot to practise with tax and employment laws," wrote Kevin Koenig, a former Goldman Sachs annotator, in a 2011 issue of Power & Motoryacht Magazine. "From a tax perspective, the U.S. government views an American working as a deckhand on a U.Southward.-flagged megayacht cruising off St. Tropez no differently than it views an insurance salesman plying his merchandise in Topeka—that is to say, a yacht flying the American flag is, essentially, on U.S. soil no matter where she is located."

Koenig added: "The financial consequences of this view tin be major for owners who cull to annals in America because they are constrained to account for U.S. taxes when paying the crewmember. With Social Security and unemployment taxes what they are, this oftentimes means paying an American crewmember twice every bit much as say, an equally qualified Australian who is exempt from U.S. taxes but who the owner could only hire were his boat registered in a more lenient, foreign-flag state."

That sentiment was echoed by Miami maritime lawyer David Neblett.

"If yous have a U.South. flag vessel, you lot fall under U.South. constabulary in crewing it," Neblett told Thousand Cayman Magazine in 2015. "Y'all accept to have workers compensation insurance for each of them. There's a big savings to hiring your crew outside the U.S....tax benefits, privacy, liability, crewing requirements, all these are good reasons for our loftier-internet-worth clients to register offshore."

The Cayman Islands in item is well positioned to take advantage of these loopholes. A 2008 Government Accountability Office study found that wealthy Americans "can minimize their U.South. tax obligations by using Cayman Islands entities to defer U.S. taxes on foreign income" and also warned that some conduct "fiscal activeness in the Cayman Islands in an attempt to avoid discovery and prosecution of illegal activeness by the United States."

Boosters of the Caymans accept boasted that such qualities could extend to yacht owners. As Grand Cayman Magazine explained: "Being a place where wealthy foreign yacht owners register their sea-going palaces offers many of the same economic advantages to the Cayman Islands as the presence of offshore banking facilities do."

The law firm at the centre of the "Paradise Papers" scandal "has a big business concern in registering yachts, particularly in the Cayman Islands, where it has set up offshore companies that claim buying of dozens of yachts and ships," the International Consortium of Investigative Journalists establish concluding year.

A case in Europe spotlighted how places like the Caymans could be used to avert taxes: in 2012, Italian authorities charged a racing mogul for allegedly using a Cayman-based shell visitor and yacht as a vehicle to avoid paying required taxes.

While there hasn't been any movement in Congress to endeavour to crack down on offshore yacht tax schemes, states take been racing to throw more money at yacht owners: in contempo years New York, New Bailiwick of jersey and Florida have been competing to slash taxes on yacht purchases and incentivize purchasers to register their yachts in state.

Proponents theorize that the benefits volition ultimately trickle down to workers in the boat manufacturing industry—but considering the tax shenanigans around yachts, that's no certain thing. The just ironclad guarantee is that the large winners in a race to cut taxes volition be magnates like DeVos who have the financial wherewithal to buy the luxury vessels in the showtime place.

Does A Registered Boat Have To Fly Us Flag,

Source: https://www.newsweek.com/betsy-devos-cayman-islands-taxes-yacht-flag-foreign-donald-trump-america-1061960

Posted by: whitehatian.blogspot.com

0 Response to "Does A Registered Boat Have To Fly Us Flag"

Post a Comment